Given the recent uncertainties in the capital markets, a lot of Real Estate Investors could be feeling unsure about the stability of their funding. We are here to assure you that Builders Trust Capital is still lending, and our funds are still readily available. If you have projects needing to close this month, we want you to feel confident that you have a locally sourced expert team here to serve you!

How do we keep our clients succeeding in a volatile market?

New Construction Loans!

As we touched on in our last blog, one of the best ways to capitalize on the continued lack of housing inventory is with new construction. Unlike when you flip a home, with new construction you don’t find ridiculous 50-year-old issues hiding behind every corner. Forget about knob and tube electrical, hidden termite damage, foundation problems, bad plumbing, or those light switches that do nothing. New construction is more straightforward; you have a plan and build to that plan. Check out the full blog for more information!

Efficient Loan Approval Process

When you choose Builders Trust Capital, you get a fast, straightforward and transparent process. And, because we’re so ingrained with the local communities we serve, we hyper-focus on each entrepreneur’s needs and goals in the following ways,

- Minimal, simple forms so you can pre-qualify quickly

- All fees are disclosed upfront to help you budget projects accurately

- Receive a complimentary profit assessment using Builders Trust Capital’s proprietary calculator and ROI coaching on your investment property

- Get your project funded in as little as 10 business days

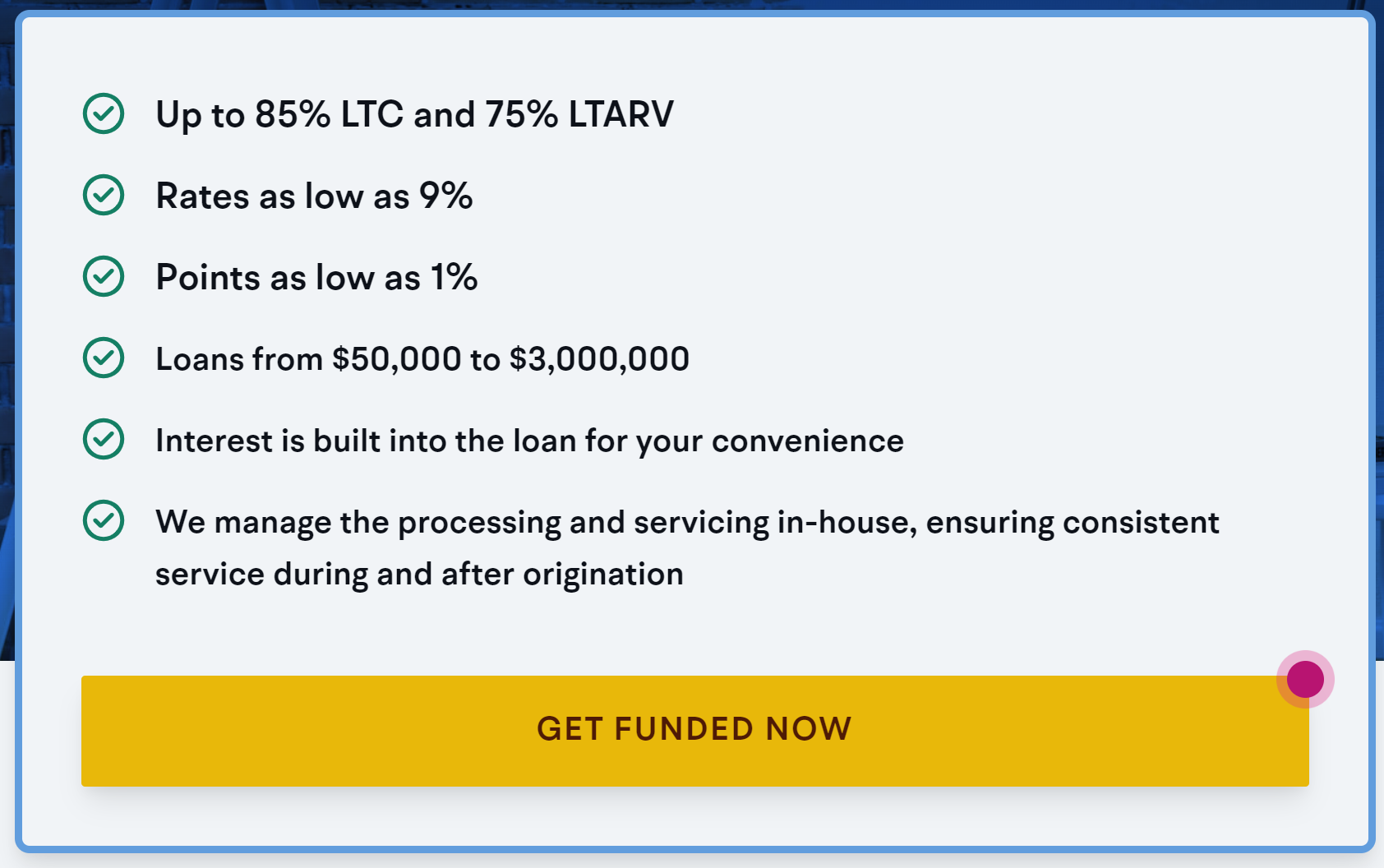

Flexibility

The Builders Trust Capital team is comprised of real estate professionals with extensive flipping and investment experience. We understand what you need – flexibility! Where a big bank forces you to fit into a traditional loan process, we tailor our approach to the project at hand; when you win, we win.

- Interest is escrowed to simplify payments, so you can focus solely on the construction of the property

- Ability to cross collateralize other property to reduce cash to close

- No limit on the number of properties

We are still lending!

Let’s get your project to the closing table this month! Fill out this form or call us at 856-422-3232 so we can contact you and begin working on your loan. We’re local and happy to meet with you to learn your funding needs.