Hot new real estate markets are popping up along the east coast and we’ve positioned our offices in every one. Our customers trust us with their businesses and their investments so we give them the advice, tools, and funding that their unique circumstances require. We’re proud of what our clients have accomplished with funding from Builders Trust Capital, and we’re excited to help more people realize their dreams each day. That’s why we’ve expanded our three loan programs into Delaware, Virginia, Maryland, Washington D.C, and Florida.

Renovation Loans

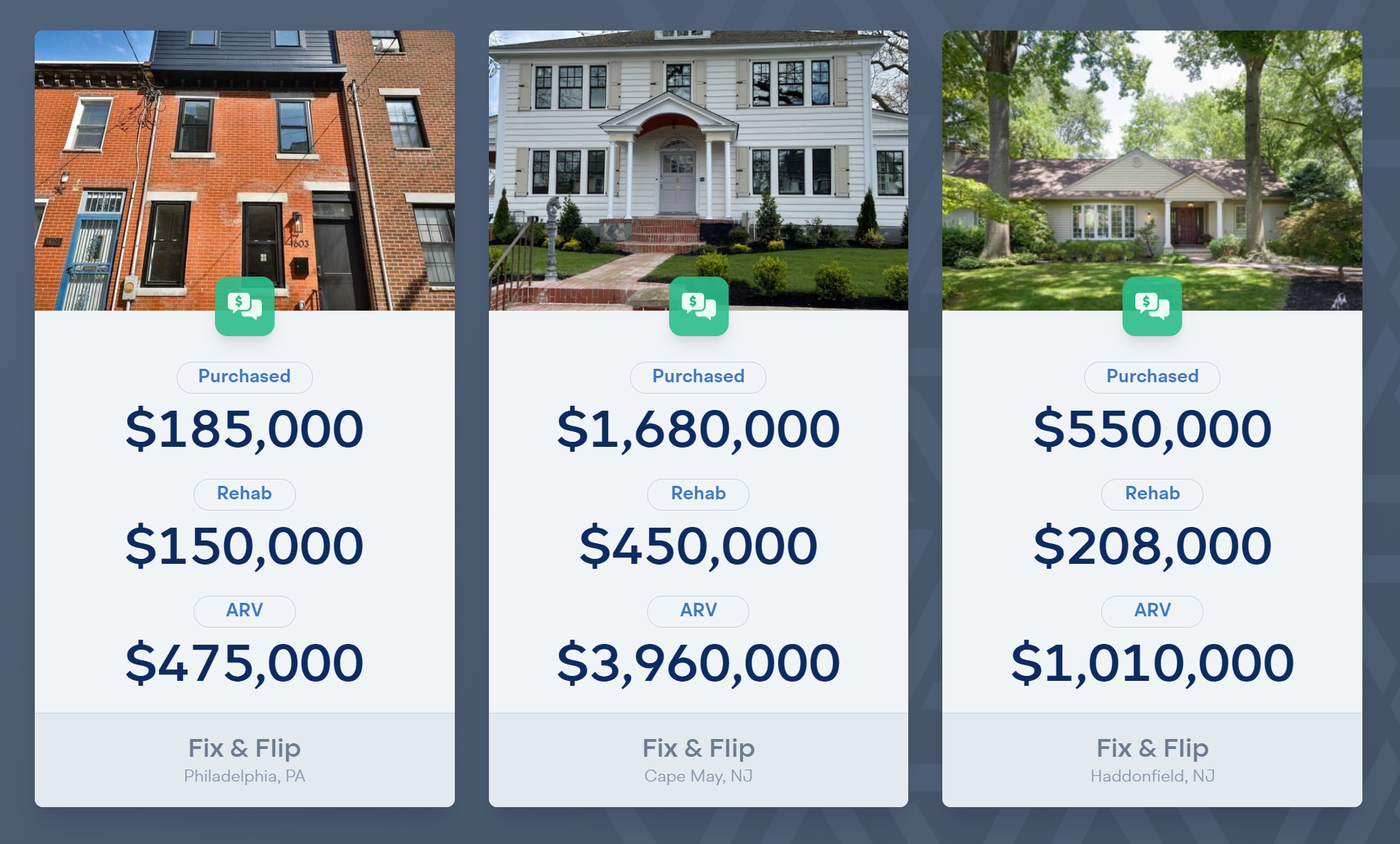

We recognize that the median home price for Washington District of Columbia reached a record-breaking $700,000. The sheer number of closed sales in the DC area also reached a ten-year record, up 23%. We know that DC is a market worth investing in because of our expertise on how to spot an ideal location for a fix and flip project. People are drawn to cities, convenience, and of course jobs. So, when Amazon announced its new headquarters in Arlington, VA, and pledged to create 25,000 jobs we knew we had to be there for our clients. We bring the speed and flexibility of a small, local lending company with the experience and lending capacity of the big banks. In every one of our locations, we allow real estate investors to close their loans in as little as 10 days with our renovation loan programs, keeping hot markets growing year after year.

Rental Loans

Rental Investment opportunities, such as traditional rentals and short-term rentals, are almost always booming in shore towns. With tourist markets increasingly a smart investment, we have posted ourselves at the key shore and beach towns of Rehoboth, Delaware, Sarasota, Florida, Bethel Beach, Virginia, and more, in addition to the NJ shoreline. Our 30-year landlord loan programs have rates as low as 3.50%. We make it easy for investors to succeed in hot markets by closing landlord loans in as little as 20 business days. We know time is money, so we keep every step of the process in-house so investors can focus on their projects and their growth.

We also help investors finance new vacation properties. New Airbnb/VRBO rental loans allow you to buy your vacation rental property without needing a traditional yearly lease. With new AirBnB/VRBO loans, properties are evaluated by looking at the actual or potential income of a given property rather than an individual borrower’s W2 income and debt-to-income ratio. At Builders Trust Capital, we stay on the cutting edge of lending, always ready to leverage our knowledge of your business, project, and financials to help serve you better.

New Construction Loans

With hot new real estate markets booming, coupled with the overall lack of housing inventory, one of the fastest ways for real estate investors to grow is through new construction. It’s our mission to provide faster, more flexible construction loans by processing and servicing loans in-house. If you’re looking to purchase a property or lot, demolish the dwelling (if any), build on the lot, and sell or rent the property for a profit, then our new construction loan programs are the perfect way to finance your real estate investment. Explore the next hot real estate market in one of our new locations, Delaware, Virginia, Maryland, Florida, and Washington D.C, as well as our traditional NJ and PA markets.

Head over to our new and improved application page, fill it out in less than one minute, and get a call within 24 business hours. We’re focused on building long-term relationships with our clients and would love to speak with you about funding your next project!